Some small businesses have even reported a slight increase in hiring as workers feel more financially secure, potentially stimulating local economies.

For seniors, expanded deductions have reduced taxable income and allowed retirees to retain more of their fixed-income resources. Individuals who were previously constrained by medical expenses or high property taxes now have additional flexibility, enabling them to afford necessary healthcare, household maintenance, and recreational activities.

Economists and policy analysts are closely monitoring the broader fiscal implications. While the law provides tangible short-term benefits, projections indicate a potential $3.4 trillion increase in the federal deficit over the next decade.

This has sparked debate over long-term fiscal responsibility. Some economists argue that the bill may necessitate future adjustments, such as spending cuts or modifications to other tax policies, to prevent worsening national debt.

Others suggest that the stimulus effect from increased consumer spending could partially offset deficit growth, though opinions vary on the magnitude of this effect.

Critics have also raised concerns about equity. While tipped employees benefit significantly from the tax exemption, salaried workers, government employees, and those in industries without tip-based compensation see no direct financial gains.

This has reignited discussions about the fairness of tax policy and whether targeted exemptions should be expanded to include other vulnerable workers. Policy think tanks have recommended additional studies to assess how income distribution and inequality may be affected by the legislation in both urban and rural areas.

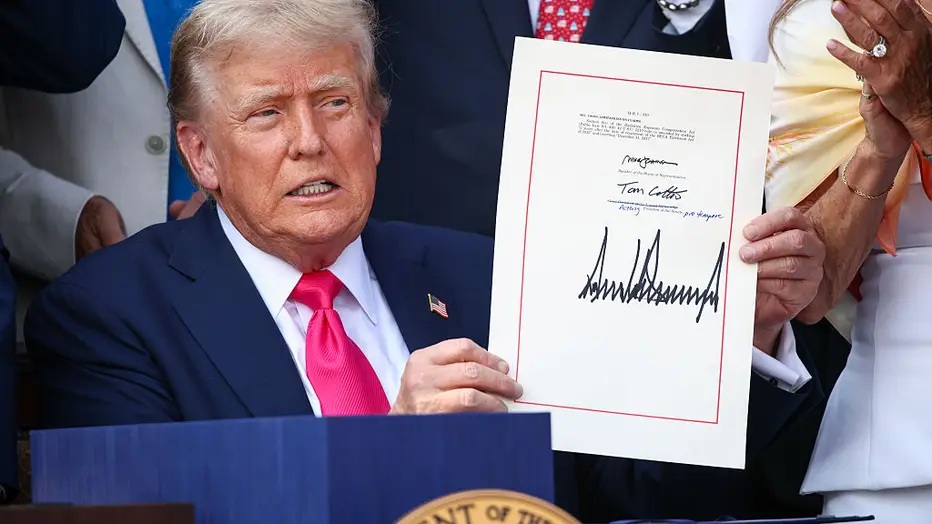

Politically, the law has become a symbol of the Trump administration’s philosophy on economic policy. Proponents highlight that the legislation prioritizes individual financial empowerment over government redistribution programs. Continue reading…